What

Burberry is a luxury fashion company based in London. In 2017, it launched a responsibility agenda that aligned with the UN Sustainable Development Goals. Building on this agenda in 2021, the company announced its pledge to become climate positive by 2040. To achieve this, Burberry aims to reduce emissions across its supply chain by 46% by 2030.

Burberry’s chief operating and financial officer (COFO) is a champion for sustainability in the organisation. The finance function drives a number of initiatives to help Burberry deliver on its ambitious goals. Group finance and risk specialists collaborate on the company’s work on the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, supported by the supply chain team. The commercial finance and corporate finance teams ensure that Burberry invests in activities that support the reduction of carbon emissions and address climate-related risks. Led by the group treasury team, Burberry issued a £300 million sustainability bond. The company believes the sustainability element of the bond contributed to a pricing advantage. Burberry also linked its bank loan facility to green KPIs, including scope 3 emissions targets.

These finance-led initiatives reflect the embedding of integrated thinking at Burberry to drive continued progress against sustainability targets throughout the company.

Burberry has set ambitious targets for carbon reduction and has developed a plan for being accountable for achieving them. The involvement of finance was clearly demonstrated.

Why

A belief in the importance of environmental and social responsibility dates back to Burberry’s founder, who established the company in 1856. Today, Burberry is committed to honouring that heritage by both investing internally in sustainability and working towards more sustainable supply chains in the fashion industry.

Climate change in particular represents a significant business risk – a risk that can only be mitigated through concerted effort at every level. Burberry’s climate goals are a means of galvanising climate action across the organisation.

Like many companies, Burberry faces growing pressure from external stakeholders. The company expects that government regulation of carbon emissions will increase. Gen Z and millennials – who make up a significant proportion of Burberry’s customer base – care about companies’ environmental credentials. Investors are becoming more interested in environmental and social performance, and Burberry’s sustainability bond was eight times oversubscribed.

The finance team recognises that it has a critical part to play in supporting the company to meet its climate goals and address the expectations of its stakeholders. Finance can drive change through its central position in the organisation, its role in business planning and its analytical approach to problems.

We believe finance can influence the organisation. We’re in a central position and able to influence teams throughout the organisation to start embedding the dimensions of sustainability into their decisions and their day-to-day operations.’

How

Burberry sets its goals to drive action throughout the business and to push for change in the luxury fashion industry:

- Having set its responsibility agenda and climate targets, Burberry is now developing its detailed road map for how to get there. A step-by-step plan will structure Burberry’s work to become climate positive by 2040.

- Burberry’s governance over climate risk and sustainability ensures that the company manages, monitors and reports appropriately on its activities and progress. A sustainability steering committee reports to the board, and the COFO attends both. The risk committee oversees how social and environmental risks are managed, including the company’s work on TCFD.

- The finance team cultivates a supportive team culture, and senior finance staff organise regular training sessions on sustainability for the global function. The COFO ensures that progress against climate and sustainability targets, including TCFD, is a focus area.

- When Burberry wanted to raise money in the bond market, the group treasury team led the process to set up a use-of-proceeds sustainability bond that aligned with Burberry’s strategy. The team identified three areas where bond proceeds would be used: the store refurbishment programme, sustainable packaging and sustainably sourced materials.

- The focus on the store refurbishment programme drove changes to the capital investment process. Sustainability metrics are now included in the appraisal process for all capital investment in buildings, including the store refurbishment programme. Decisions are made based on both a finance and sustainability assessment.

- The group treasury team also linked the cost of its bank facility to two different sustainability KPIs. To support the company’s recently stated goal to become climate positive, one of the KPIs is a scope 3 carbon emissions target.

- A cross-functional TCFD working group, led by finance, reports to the risk committee. Burberry uses the results of its climate impact assessment scenario modelling to formulate mitigation actions that are embedded in in its strategic and resource planning.

- Burberry also champions change in the fashion and luxury industry. To help make supply chains more sustainable, the company partnered with the Apparel Impact Institute to launch a programme that funds environmental programmes for Italian manufacturers. Burberry also helped a UN Climate Change working group to develop climate action training for companies in the fashion industry supply chain.

Managing climate risk with TCFD

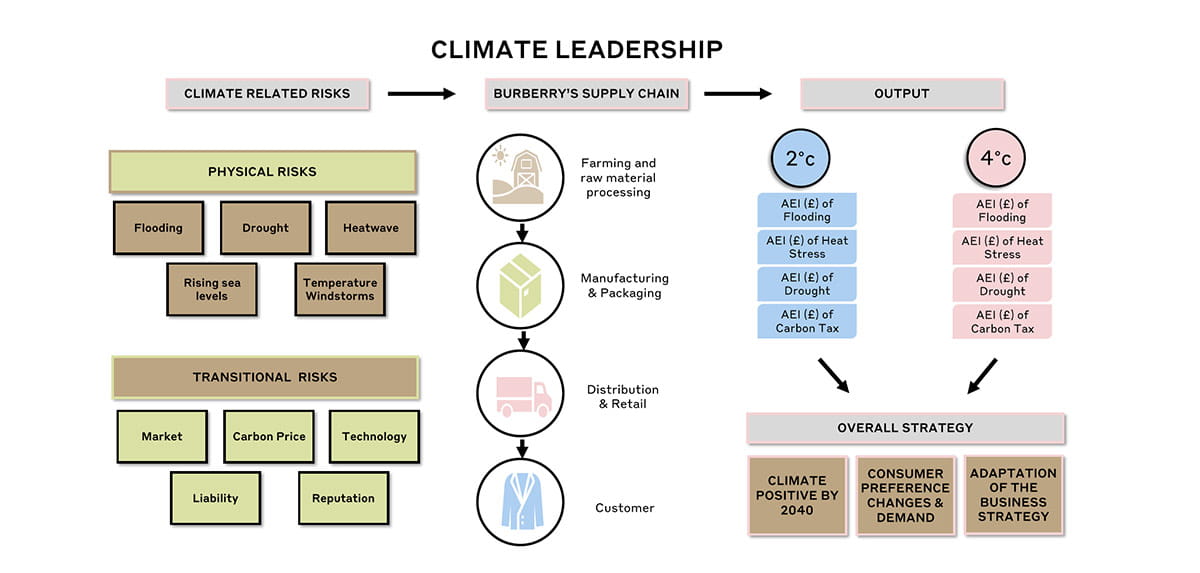

The TCFD working group held workshops with teams across the business, including the supply chain and responsibility teams. Through the workshops, Burberry learned more about how climate-related risks could impact the company and its supply chain for key commodities, such as cashmere, cotton and leather.

Burberry used industry-referenced scenarios, such as Representative Concentration Pathways and Shared Socioeconomic Pathways, to analyse the potential impacts of climate change for different scenarios across the supply chain. The team considered a range of risks, including locations that were more susceptible to flooding, the potential impact on productivity of heat-related stress and changes to climate policies and taxes.

Two scenarios – a 2°C and a 4°C warming scenario – were chosen, which represented the ‘best’ and ‘extreme worst’ scenarios which had enough good quality data available for the analysis. The resulting analysis showed the most material physical and transitional risks up to the year 2050. One important finding was the material impact of transitional risk on the company, particularly from a

carbon tax. Equipped with an understanding of the material risks it faces, Burberry can manage its climate-related risk more effectively.

Download the case study

Want a copy of this case study? You can download a PDF version using the link below.