What?

The Ceres Accelerator for Sustainable Capital Markets is a centre of excellence within Ceres, a US non-profit organisation focused on sustainability. The Ceres Accelerator encourages key actors in the capital markets to take climate change into account in their work, including standard setting, risk management and decision making.

The four main groups the initiative targets are financial regulators, banks and other financial institutions, corporate boards, and investors.

The Ceres Accelerator’s advocacy activities help these influential groups to understand the financial implications of climate change and the steps they can take to make progress. The initiative directly engages with organisations, produces thought leadership through reports and other written content, runs webinars and training, and submits responses to policy consultations.

Between January 2021 and May 2022, the Ceres Accelerator has met with more than 1,300 regulators and influencers, hosted more than 2,000 attendees at virtual events, and enrolled more than 100 corporate directors on its training course for board directors.

Beyond the US, the Ceres Accelerator collaborates with international partners to expand its reach, including Climate Action 100+, the Investor Agenda and the Net Zero Asset Managers Initiative.

The Ceres Accelerator for Sustainable Capital Markets is achieving significant change by driving action in the US capital markets. We were particularly impressed with their commitment to a just transition, and to addressing the racism inherent in society and particularly in the finance sector.

Why?

The Ceres Accelerator views climate change as a systemic financial risk that needs to be addressed through concerted action in the capital markets. This requires a shift from short-term thinking towards a longer-term view of risk and opportunity that centres on sustainability.

The underlying theory of change behind the initiative’s focus on individual actors is that moving key financial players drives broader change. For example, regulators’ approach to climate-related financial disclosures can have a direct impact – and ripple effect – throughout the markets as a whole. Beyond regulators, the Ceres Accelerator believes that financial institutions need to manage climate risks, boards need to have stronger oversight over ESG, and investors need to align their portfolios with the Paris Agreement.

The ultimate goal is to achieve a net zero economy, with climate considered in all aspects and areas of the market. For the Ceres Accelerator, though, this transition to a net zero economy must also be a just transition: actors in the capital markets need to understand the ways in which marginalised groups are especially vulnerable to climate change and use this to guide their actions. The Ceres Accelerator takes the need for a just transition into account throughout its advocacy and recommendations.

We focus on the financial players in the market place and move them through voluntary efforts […] and through regulatory efforts. The theory of change is that if you can move the financial players, that will trigger change in the entire market place.

How?

The Ceres Accelerator uses a range of approaches to accelerate change among its four focus groups:

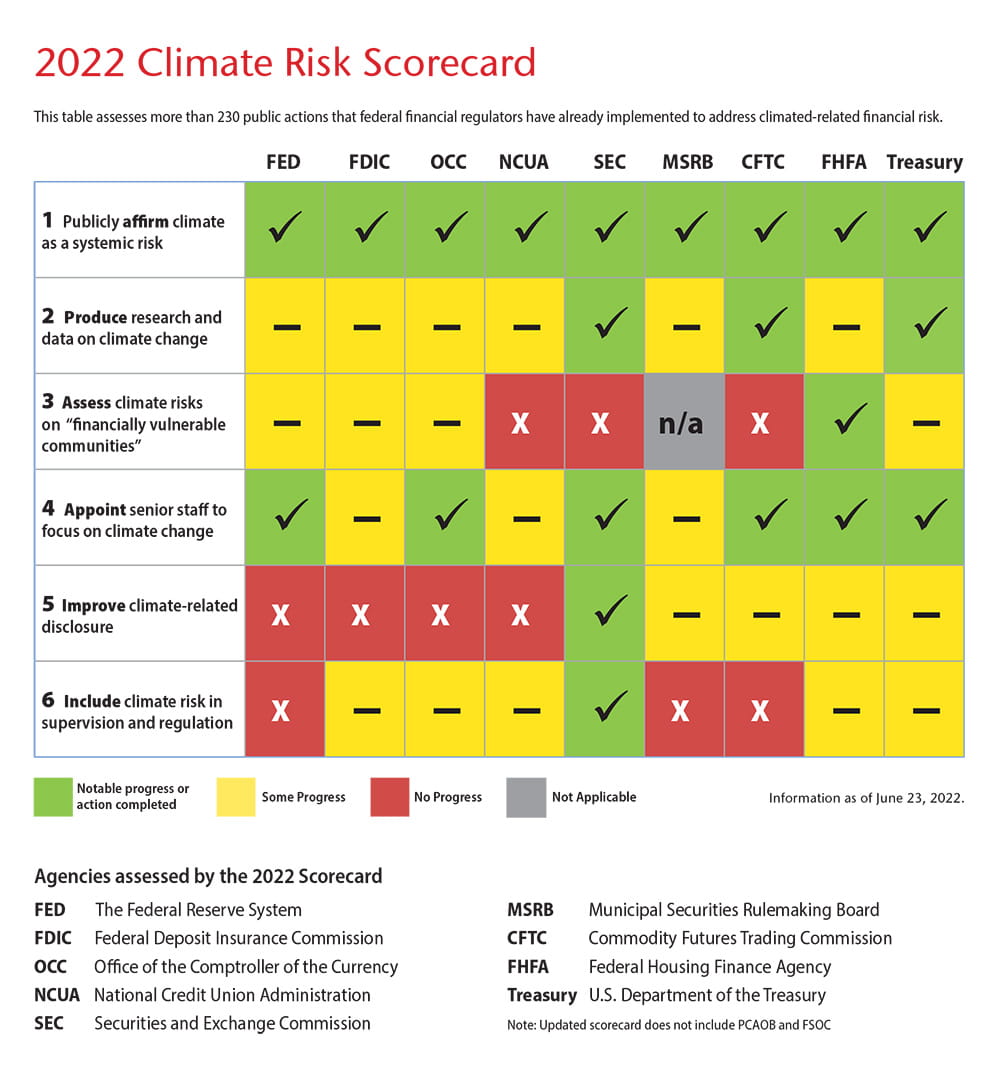

- In 2021, the initiative launched its financial regulator scorecard. It produced a second, updated and expanded, scorecard in 2022. The latest scorecard evaluates the progress of nine US financial regulators – including the SEC, the Federal Reserve System and the Department of the Treasury – against six recommended climate actions. The first of these is whether a regulator has affirmed that climate is a financial risk.

- Producing the scorecards involved direct engagement with regulators, including many individual meetings. The Ceres Accelerator also gave regulators time to give feedback on the scorecards before publication. Reflected in the second scorecard are 230 separate climate actions taken by regulators since the first scorecard was released.

- Other work with regulators includes filing responses to public requests for comments. In its responses, the Ceres Accelerator makes concrete recommendations and then tracks whether these recommendations are included in the final regulations.

- As well as its own responses, the Ceres Accelerator lobbies other capital markets actors to comment in favour of climate regulations. The initiative met with major banks during the comment period for the SEC’s proposed mandatory climate disclosure rule for corporations. In October 2022, the initiative also published its analysis of investor responses to the proposed change, showing a high level of support.

- The Ceres Accelerator produces a wide range of reports and articles on climate risks, opportunities and recommendations for different sections of the capital markets, including banks and investors. Its content is practical in focus, explaining the issues and giving decision makers the knowledge and tools to help them address climate change in their activities. The initiative’s webinars and other events take a similar approach.

- A recent report assesses S&P 100 companies against 17 indicators of corporate climate action. These indicators are based on the Ceres Accelerator’s recommendations for corporations, grouped into four categories: assess material and systematic climate risks, systematise decision making for climate risks, advocate in favour of science-based climate policies and engage trade associations to support science-based climate policies. The report is part of ongoing engagement with corporations and future reports will track progress.

- The governance team in the Ceres Accelerator collaborated with UC Berkeley to produce an online course aimed at corporate board directors, ‘ESG: Navigating the Board’s Role’. The training covers specific aspects of ESG governance, including ESG risk management and linking ESG to executive compensation.

Download the case study

Want a copy of this case study? You can download a PDF version using the link below.